This post was originally published on this site

https://d1-invdn-com.akamaized.net/content/pic42341ede3fdbbabc824fe74efd663909.jpg

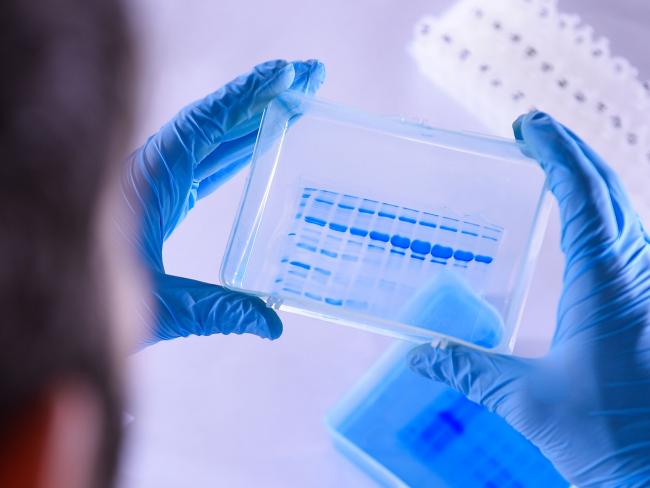

The ETFMG Treatments, Testing and Advancements ETF, which started trading Thursday under the ticker GERM, gives access to both established biotechnology companies and “unsung heroes,” the firm said in a statement. The fund tracks an index whose biggest holding is Moderna (NASDAQ:MRNA) Inc., a company that’s seen its stock price more than triple this year on news of its vaccine development progress.

As global coronavirus cases exceed 8.3 million, companies, health authorities, drug regulators and research institutes are working around the clock to come up with the world’s first effective vaccine for Covid-19. Concern over a second wave of the pandemic threatens recent efforts to relax restrictions and revive businesses after months of lockdowns.

“Everyone is thinking about treatments and vaccines,” said Sam Masucci, chief executive officer and founder of ETF Managers Group. “It touches them very personally. We tried to develop a product of all the companies at the forefront that will hopefully get us back to a more normalized life.”

The fund has a 0.68% expense ratio.

Earlier this year, Pacer Financial filed for a BioThreat ETF (VIRS), which is focused on companies combating biological threats to human health.

This kind of thematic fund is effectively “a trifecta bet” — meaning the issuer has to get the theme, stocks and valuations right, according to Ben Johnson, director of global ETF research at Morningstar Inc.

©2020 Bloomberg L.P.