This post was originally published on this site

https://i-invdn-com.akamaized.net/trkd-images/LYNXNPEG3F1C1_L.jpg

BOSTON (Reuters) – Activist shareholders are likely to scale back campaigns in coming weeks as target companies brace for a deep recession and their favorite calls for change – ranging from mergers to returning cash – are ignored during the coronavirus outbreak.

The year started on a strong note with firms like Third Point and Elliott Management committing billions to push for change at 42 companies in January and February.

But the pace fell 38% in March from February with only 16 campaigns launched, data released on Thursday by investment bank Lazard show.

New campaigns last month were launched at the slowest pace since 2013 and corporate agitators put the smallest amount of money to work since 2016.

Activity is expected to remain slow in the weeks ahead, the bank said.

“We saw COVID-19’s impact on activism show up in March,” said Jim Rossman, who heads shareholder advisory at Lazard. “Lower M&A activity and companies focused on conserving cash will mean that activists are likely to increase their focus on operational performance and how management teams react to the crisis as the basis for new campaigns.”

Activists, who often call on target companies to sell themselves or spin off units, pulled back last month and of the 16 campaigns launched in March, only five had an M&A component, Lazard said.

Similarly companies now worry about conserving cash and 123 U.S. companies ranging from Hilton Worldwide (N:HLT) to Home Depot (N:HD) have suspended or cut back share buyback programs as management braces for the worst downturn since the 1930s Great Depression.

For activists used to pressing for buybacks such requests would likely fall on deaf ears now. Only one campaign launched in the first quarter included a request for the return of capital, Lazard said.

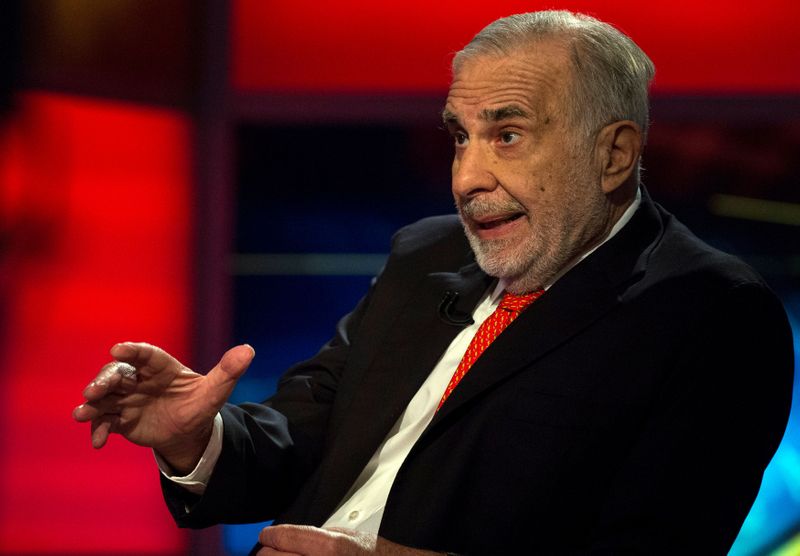

Some activists, including Carl Icahn and Starboard Value LP seized on coronavirus-inspired panic selling to buy more stock in target companies but others pulled back, suggesting a generally gentler tone, for now.

Elliott dropped its opposition to consulting firm Capgemini’s (PA:CAPP) friendly takeover of rival Altran (PA:ALTT), citing market conditions. Land & Buildings withdrew its director candidate at real estate investment trust American Homes 4 Rent (N:AMH), saying management needs to focus on running the business during the current turmoil.

Many activists are careful to avoid looking overly aggressive during the pandemic, Rossman said, noting they don’t want to offend other investors whose help they might need in pushing their case later.