This post was originally published on this site

https://i-invdn-com.akamaized.net/trkd-images/LYNXNPEG3E2HL_L.jpg

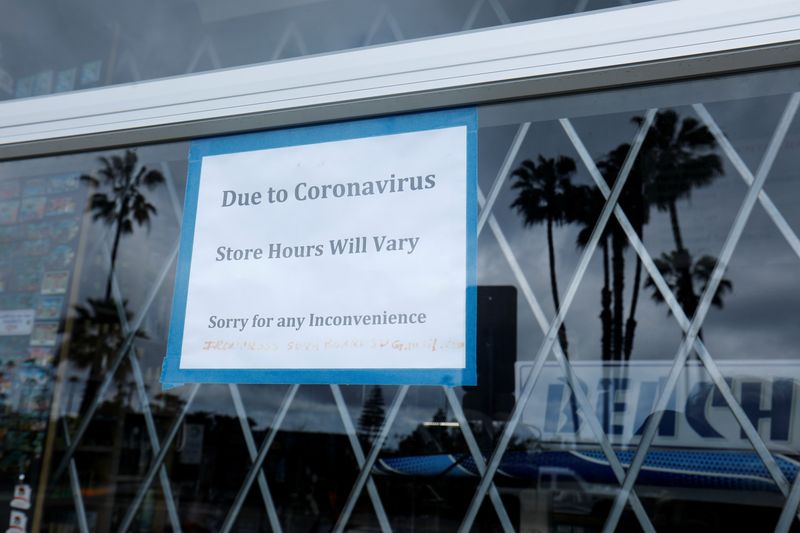

NEW YORK (Reuters) – After closing their doors to prevent the spread of the coronavirus, many small businesses face an uncertain future following government-ordered lockdowns.

As part of our weekly #AskReuters Twitter chat series, Reuters gathered a group of small business experts on April 15 to answer questions about federal aid, business strategy and managing an organization amid a crisis.

Below are edited highlights.

Where can small businesses still look for help and what documents do they need?

“The Small Business Association (SBA)’s Paycheck Protection Program (PPP) loan program can provide loans that are forgiven if used to maintain employees’ jobs. There are also Disaster Relief Loans and many others governed by the SBA. Each loan has an application. The servicer may require additional documents.”

— Janet Alvarez, executive editor of Wise Bread

Who should apply for economic disaster injury loans and/or paycheck protection loans?

“Generally speaking small businesses with 500 or fewer employees qualify. There are some exceptions that allow larger small businesses to qualify.”

— Tom Sullivan, vice president of small business policy at the U.S. Chamber of Commerce

How long should small businesses expect to wait for federal aid?

“Banks have 10 days to fund approved PPP loans. Economic Injury Disaster Loans take three to five days for approval then up to three weeks for funds. To cut red tape, have all documents in order.”

— The American Institute of Certified Public Accountants

What should small businesses do in the meantime if they are strapped for cash?

“First, know that you’re not alone and not a failure. If you can, cut costs and get creative as much as possible. Sell gift cards, go online, do what you can. Ask your landlord if they can give a reprieve. There is no harm in asking friends or family for help if they can.”

— Lendio

How should small companies communicate with customers in a time of crisis?

“From a customer’s point of view: less is more! I am flooded with emails from every company I’ve ever done business with.”

— Beth Pinsker, Reuters journalist and a certified financial planner

When should a small business pivot to doing something else?

“If you clearly see that what you do is going the way of the dinosaurs, take action now before it’s too late, and you are psychologically defeated. Find the next gig that is growing, and interests you and has longevity.”

— Kashif A. Ahmed, founder and president of American Private Wealth, LLC

How can a small business owner tell if their accountant is on top of all the important financial tasks?

“To start, small business owners must continually communicate with their accountant and ask any questions they have based on their understanding of the financial situation. Also, ask your accountant to update you as they receive new information.”

— Principal Financial Group (NASDAQ:PFG)

What is the biggest mistake a small business can make in a time of crisis?

“Not being nimble, insensitive to change, and failing to realize that the crisis will abate. Think about both the short-term and long-term. Consider what you are doing so your customers will want to do business with you when this crisis is over.”

— Bob Chalfin, lecturer in management at The Wharton School of the University of Pennsylvania

When it comes to small business, what are you optimistic about right now?

“So many small business owners are determined, passionate and resilient people. Some of the most creative thinkers I’ve encountered. I hope entrepreneurs can find a way to innovate and outsmart this crisis.”

— Melissa Wylie, small business writer at LendingTree

(Editing By Lauren Young and Aurora Ellis)