This post was originally published on this site

https://i-invdn-com.akamaized.net/news/LYNXNPEC0Q0L5_M.jpg © Reuters.

© Reuters.By Gina Lee

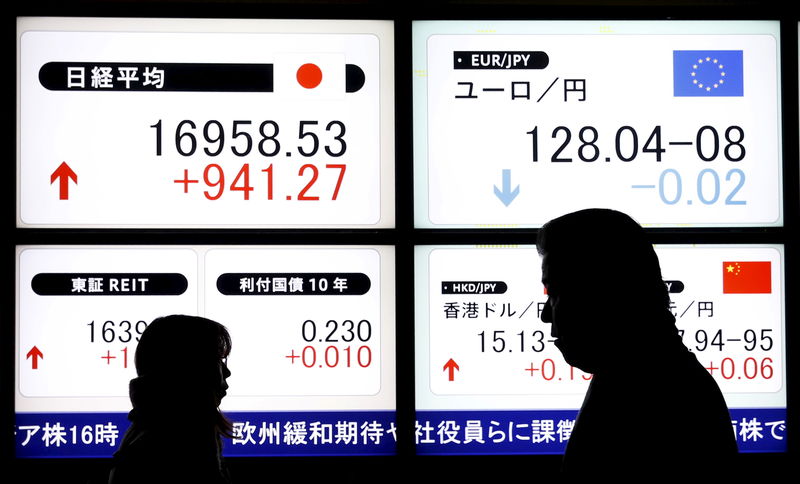

Investing.com – Asian stock markets continued their gains on Tuesday as falling COVID-19 numbers improved investor sentiment.

The United States, Italy and Spain reported declining case figures over the weekend.

The slipped 0.5%, flattening its earlier gains by 10:23 PM ET (3:23 AM GMT). The Reserve Bank of Australia is set to announce its interest rate decision later in the day. Analysts are predicting a 0.25% cut in forecasts prepared by Investing.com.

South Korea’s gained 0.95% as Samsung Electronics (KS:) announced a first-quarter profit of around $5.2 billion, slightly above forecasts. Neighboring Japan’s gained 0.93% as Prime Minister Abe announced a JPY 39 trillion ($357.55 billion) stimulus package ahead of declaring a state of emergency.

Hong Kong’s was up by 0.26%. China’s was up 1.53% while the was up 2.32% as they returned from a holiday.

“Risk sentiment is improving,” citing factors such as a slowing pace of the daily death toll in Spain and France as well as new confirmed cases in New York rising at a slower pace,” BK Asset Management managing director of foreign exchange strategy Kathy Lien said in a note yesterday.

But with the World Health Organization stating that the number of global cases topped 1.2 million with almost 70,000 fatalities as of April 7, Lien ended her note with a warning to investors.

“These trends suggest that lockdown measures are ‘working’ but it is still too early to tell if these improvements are sustainable. Hospitalizations tend to be lighter over the weekend and in some countries in Asia where it seemed like the curve flattened, new cases are cropping up,” she said.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.