This post was originally published on this site

https://i-invdn-com.akamaized.net/news/LYNXNPEC502EA_M.jpg

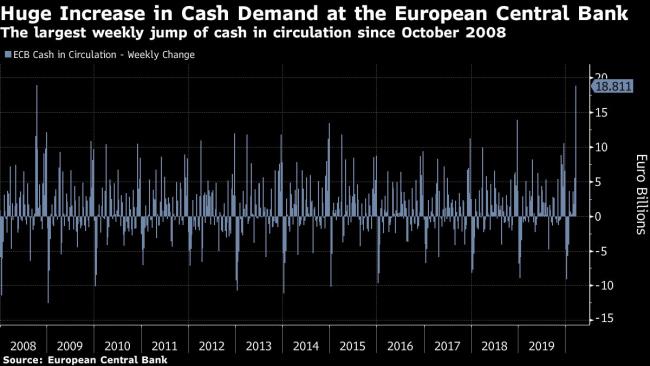

Cash jumped by by almost 19 billion euros ($20 billion), according to European Central Bank data. The ECB’s total balance sheet expanded by 223 billion euros as massive liquidity injections added to assets.

With consumers in the euro-area ramping up spending as they try to stockpile goods ahead of coronavirus shutdowns, demand for notes and coins has spiked.

The last time the jump was this large, the generally accepted reason was cash hoarding amid fears of imminent bank failures.

“The strong increase in weekly demand seen last week is to a large extent likely to be explained by people spending more in supermarkets and shops due to uncertainty related to the coronavirus pandemic,” an ECB spokesperson said. “The demand for banknotes in that week was similar to the demand in the week for Christmas.”

Under its rules, the ECB must meet all cash requirements from banks, so the institution has no direct control over the amount of physical currency in the region.

©2020 Bloomberg L.P.