This post was originally published on this site

https://i-invdn-com.akamaized.net/trkd-images/LYNXMPEG291HM_L.jpg

By Jessica DiNapoli and Svea Herbst-Bayliss

(Reuters) – More U.S. companies are moving their annual shareholder meetings online to help contain the spread of coronavirus, raising concerns among corporate democracy advocates about investors losing access to top executives and board directors.

Starbucks Corp (O:) this month canceled its annual shareholder meeting in Seattle, known for attracting big crowds with free coffee, and said it would hold a “virtual” meeting for its shareholders instead on March 18.

Chip maker Qualcomm Inc (O:) is restricting access to its shareholder meeting on Tuesday to exclude people who have traveled to areas stricken by coronavirus, such as China and Italy. It will provide a webcast in addition to the in-person event.

Software developer F5 Networks Inc (O:) will for the first time allow shareholders to vote electronically as part of its virtual meeting on Thursday. F5 will also hold an in-person meeting in Seattle, but cautioned its investors about health and safety issues.

“We are seeing more and more companies discuss and consider moving toward virtual meetings this year due to the coronavirus issue,” said Courtney Adante, president of security risk advisory at global consulting firm Teneo.

The coronavirus outbreak, which originated in China last year and causes the sometimes deadly respiratory illness COVID-19, has killed more than 4,000 people globally and has been reported in 122 countries.

Developer meetings at Facebook Inc (O:) and Alphabet Inc (O:), conferences such as music and technology festival South by Southwest and religious gatherings at churches and synagogues have been canceled outright to curb coronavirus.

‘CHERRY-PICKING CONCERNS’

Companies are hoping the digital meetings will help prevent the spread of the virus, while also providing access to shareholders who would not have attended the meetings physically. Many U.S. shareholder meetings are held in April and May.

“Holding a virtual meeting eliminates the enhanced risk of infections and the related legal exposure,” said Kai Liekefett, a partner at law firm Sidley Austin LLP, referring to the risk of investors filing lawsuits against companies if they become ill at the meetings.

Some investors see a worrying trend. They are concerned that these changes will become permanent, curtailing shareholders’ ability to demonstrate at the meetings and grill corporate management and boards of directors in person.

“If it is a virtual-only meeting, they can cherry-pick questions, they can avoid protests. This is not something shareholders want, it’s something boards and CEOs want so they can be unaccountable to shareholders,” said James McRitchie, an investor and shareholder advocate.

Starbucks and F5 did not respond to requests for comment about the effect of virtual meetings on access to their executives and board members. A Qualcomm representative pointed to disclosures on its website, which state that shareholders who attend its annual meeting in person must fill out a questionnaire regarding their travels.

To be sure, only a small fraction of companies currently host their annual shareholder meetings on the internet. Yet even before the coronavirus outbreak that number was growing. Some 248 U.S. companies held virtual shareholder meetings in the 2019 corporate voting season, up 17% from the year before, according to accounting and consulting firm PwC.

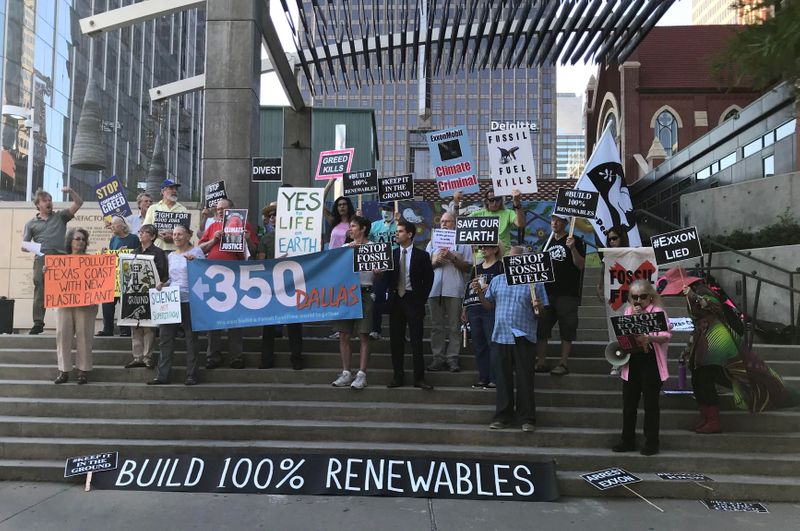

CLIMATE ACTIVISTS WORRIED

Environmentalists are particularly concerned. Climate activists have become a fixture at the annual shareholder meetings of oil majors Exxon Mobil Corp (N:) and Chevron Corp (N:). While Exxon and Chevron have yet to announce virtual shareholder meetings, activists say they risk losing an important forum that they use to pressure the companies.

“Managements and boards have disproportionate control over the flow of information and the ability of shareholders to ask questions,” said Jonas Kron, director of shareholder advocacy at investment management firm Trillium Asset Management LLC, which submits proposals on climate change and racial and gender equity. “(An annual shareholder meeting) is one of the few places where unscripted organic engagement can happen between management and shareholders.”

Exxon said this week it is still planning to hold its annual meeting in Dallas this year and Chevron said it continues to “monitor the situation very closely” and that its primary concern is the health and safety of employees.

The world’s largest annual shareholder meeting is still on, for now. Warren Buffett’s Berkshire Hathaway Inc (N:) said last week that its shareholder meeting in Omaha, Nebraska, on May 2, which typically draws 40,000 people or more and includes events such as a picnic and a 5k run, would go ahead. It added that the scope of the surrounding events may be “modified.”

“Postponing meetings may be a more respectful approach,” said Tim Smith, who leads shareholder engagement efforts at socially responsible investment management firm Boston Trust Walden Company. “We would argue this should not become a precedent.”