This post was originally published on this site

https://i-invdn-com.akamaized.net/news/LYNXNPEF0S1RW_M.jpg © Reuters.

© Reuters.By Kim Khan

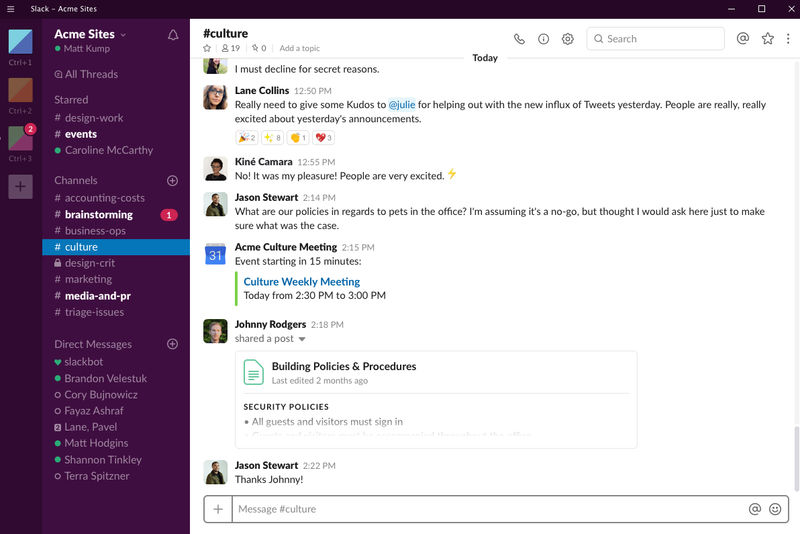

Investing.com – Slack Technologies (NYSE:) jumped sharply Monday on a report that IBM (NYSE:) is switching to its workplace messaging and communications software.

The stock popped 14% in afternoon trading.

component IBM will have 350,000 employees using Slack, becoming the company’s biggest customer, Business Insider reported.

The stock has been getting votes of confidence from Wall Street of late.

Last week RBC capital markets of the stock with an outperform rating and a price target of $25.

“While the simplistic take on Slack is that it is ‘just another workplace chat tool,’ we believe that the vision around becoming the primary system of engagement for all employees inside (and increasingly outside) an organization creates a positive data feedback loop (more engagement – more data – more insights to drive better results – more engagement) and significant long-term value,” RBC analyst Alex Zukin wrote in an note, according to Briefing.com.

Also last week, Robert W. Baird put the stock on its Fresh Pick list.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.