This post was originally published on this site

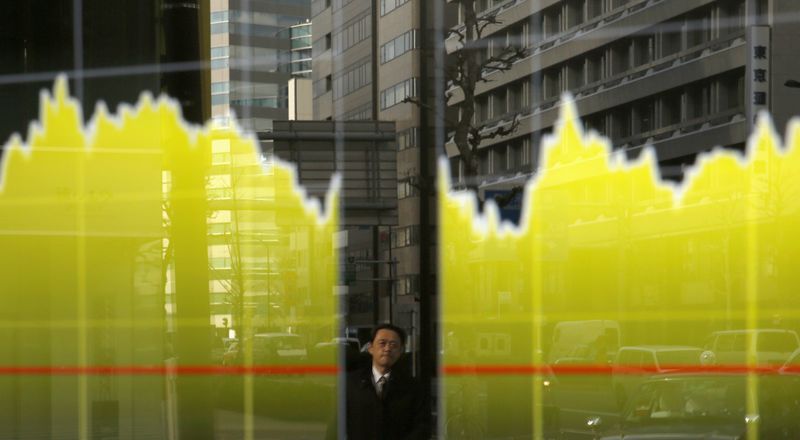

https://i-invdn-com.akamaized.net/news/LYNXMPEB1M007_M.jpg © Reuters. Japan stocks higher at close of trade; Nikkei 225 up 0.49%

© Reuters. Japan stocks higher at close of trade; Nikkei 225 up 0.49%Investing.com – Japan stocks were higher after the close on Tuesday, as gains in the , and sectors led shares higher.

At the close in Tokyo, the rose 0.49%.

The best performers of the session on the were Panasonic Corp (T:), which rose 10.04% or 108.0 points to trade at 1183.5 at the close. Meanwhile, Ebara Corp. (T:) added 9.41% or 285.0 points to end at 3315.0 and Kikkoman Corp. (T:) was up 5.81% or 300.0 points to 5460.0 in late trade.

The worst performers of the session were Unitika, Ltd. (T:), which fell 5.88% or 23.0 points to trade at 368.0 at the close. Maruha Nichiro Corp (T:) declined 4.38% or 116.0 points to end at 2532.0 and Nomura Holdings Inc (T:) was down 2.76% or 15.3 points to 540.0.

Rising stocks outnumbered declining ones on the Tokyo Stock Exchange by 2767 to 823 and 179 ended unchanged.

Shares in Panasonic Corp (T:) rose to 52-week highs; up 10.04% or 108.0 to 1183.5. Shares in Maruha Nichiro Corp (T:) fell to 3-years lows; down 4.38% or 116.0 to 2532.0.

The , which measures the implied volatility of Nikkei 225 options, was unchanged 0.00% to 14.88.

Crude oil for March delivery was up 1.06% or 0.53 to $50.64 a barrel. Elsewhere in commodities trading, Brent oil for delivery in April rose 0.59% or 0.32 to hit $54.77 a barrel, while the April Gold Futures contract fell 0.26% or 4.05 to trade at $1578.35 a troy ounce.

USD/JPY was up 0.17% to 108.86, while EUR/JPY rose 0.12% to 120.31.

The US Dollar Index Futures was up 0.14% at 97.760.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.