This post was originally published on this site

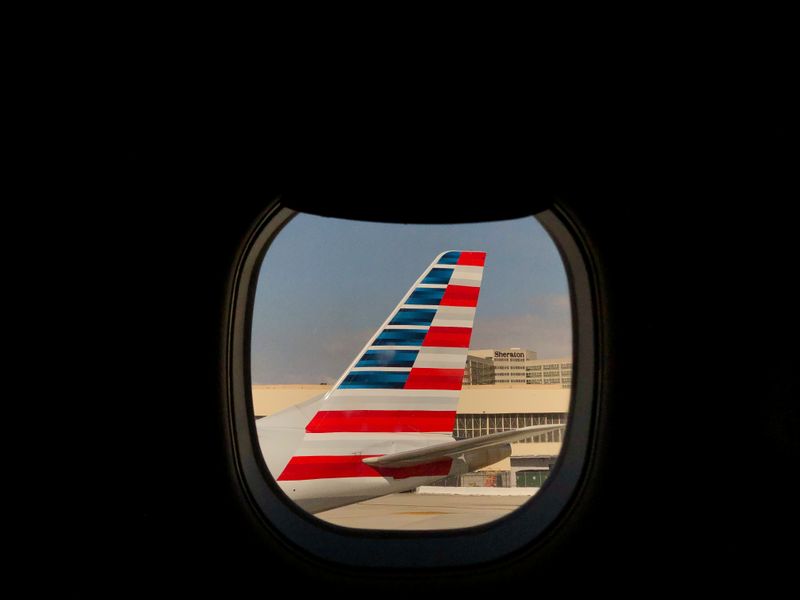

https://i-invdn-com.akamaized.net/trkd-images/LYNXMPEG0M1CZ_L.jpg © Reuters. An American Airlines airplane sits on the tarmac at LAX in Los Angeles

© Reuters. An American Airlines airplane sits on the tarmac at LAX in Los Angeles(Reuters) – American Airlines Group Inc (O:) edged past Wall Street estimates for quarterly profit on Thursday, as strong travel demand and lower fuel costs cushioned the U.S. carrier from flight cancellations due to the 737 MAX grounding.

Shares of the company rose 1.4% as revenue passenger miles flown, a closely watched industry measurement, rose 6% in the fourth quarter.

American, like its peer Southwest Airlines (N:), has been under pressure from the worldwide grounding of Boeing’s 737 MAX planes since March last year. American, which has 24 MAX jets in its fleet, has indicated that it would keep the jet out of its schedule till early June.

The airline said on Thursday that it had canceled 10,000 flights in the quarter due to the grounding.

It said it expects 2020 full-year adjusted earnings between $4 and $6 per share, compared with the average analyst estimate of $5.10 per share, according to Refinitiv data.

Net income rose to $414 million, or 95 cents per share, in the fourth quarter ended Dec. 31, from $325 million, or 70 cents per share, a year earlier.

Revenue rose 3.4% to $11.3 billion.

Excluding items, American earned $1.15 per share, above the average analyst estimate of $1.14 per share, according to IBES data from Refinitiv.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.