This post was originally published on this site

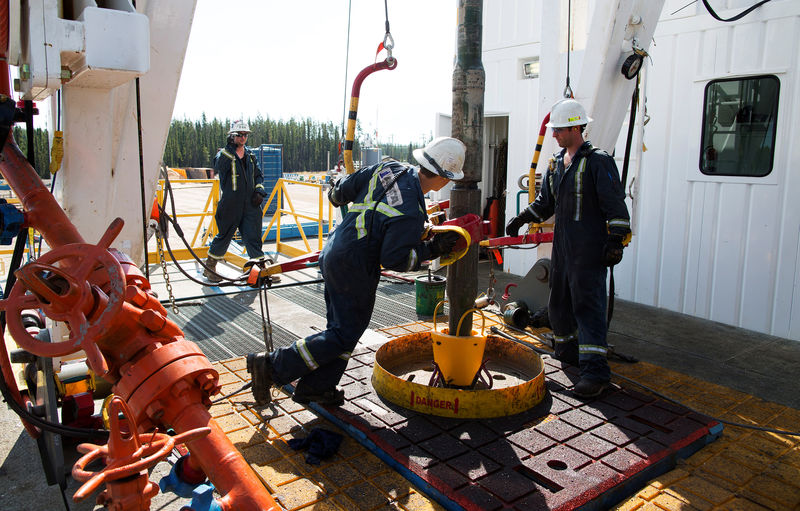

https://i-invdn-com.akamaized.net/news/LYNXNPEF0F1NE_M.jpg © Reuters. Energy Shares Are ‘Downright Cheap,’ David Rosenberg Says

© Reuters. Energy Shares Are ‘Downright Cheap,’ David Rosenberg Says(Bloomberg) — Energy stocks are cheap among S&P 500 peers, and there’s already plenty of bad news baked into the sector, according to David Rosenberg.

“In a world where everything looks so expensive, energy stocks look downright cheap,” Rosenberg, the chief economist & strategist of newly formed Rosenberg Research and Associates, told clients in a note.

His call comes as oil markets weigh geopolitical risk, while U.S. shale companies attempt to lure investors back after extended underperformance.

Energy stocks staged a mid-December rally, but have cooled alongside and eased U.S.-Iran tensions. The sector risk-reward looks more balanced after such events, Morgan Stanley (NYSE:) told clients early Monday, downgrading the exploration & production group to “in-line.”

“At a minimum, the group is priced for a much weaker oil environment than what we have on our hands,” Rosenberg said.

In addition to the sector’s valuation, investors have expected negative events for some time. “There are few sectors in the equity market that have this characteristic of having bad news priced in at this moment,” he wrote. “But in the energy space, perhaps in the overall materials sector as well, all that has to happen is for something bad not to happen and there will be a positive rerating as the end-result.”

Rosenberg was chief economist and strategist at Gluskin Sheff and Associates for about ten years before firing up his own firm.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.