This post was originally published on this site

https://i-invdn-com.akamaized.net/trkd-images/LYNXMPEG0809U_L.jpg

By Yilei Sun and Brenda Goh

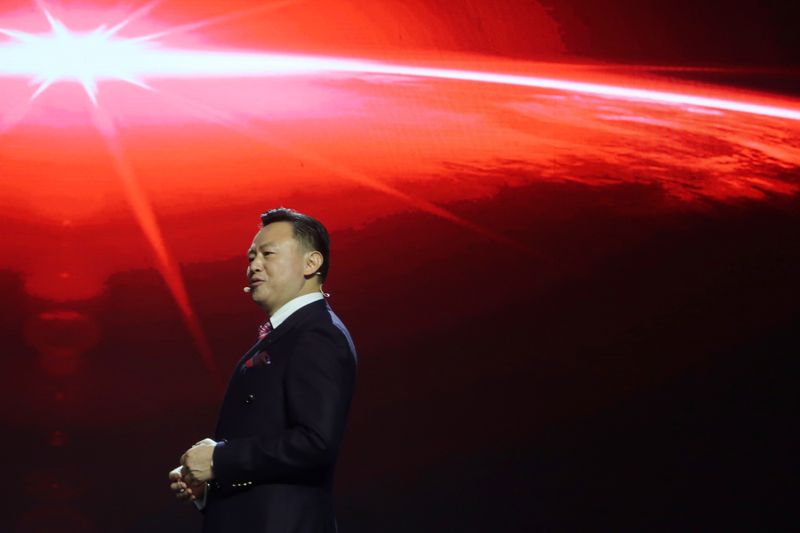

BEIJING/SHANGHAI (Reuters) – China’s FAW Group [SASACJ.UL] aims to double its annual sales of Chairman Mao Zedong’s carmaker of choice, Hongqi, or Red Flag, to 200,000 units this year and grow them further to 1 million cars in the next decade, its chairman Xu Liuping said.

Hongqi, launched in 1958 by the state-owned carmaker, will have 21 car models under its marque and 18 of them will be electrified by 2025, Xu said at an event held in China’s Great Hall of People late on Wednesday.

Hongqi, based in the northeastern city of Changchun, has undergone several revamps over the decades, falling out of favor for a period in the 1980s.

But it has seen a recent revival amid a national push to promote Chinese brands and has been President Xi Jinping’s ride of choice during recent military parades.

Regarded as a cultural symbol of China’s ruling Communist Party, Hongqi in 2018 hired former Rolls-Royce (LON:) designer Giles Taylor, whose works include Rolls-Royce’s Phantom VIII limousine and the brand’s first sport-utility vehicle model Cullinan, to head its design team in Munich.

Xu said China’s car market, the world’s largest, was also becoming its most competitive, with Hongqi emerging as a benchmark for China’s premium local brands.

Hongqi expanded its dealership system to around 271 sites in China and sold 100,166 cars last year. It plans to sell 200,000 units this year, 400,000 units in 2022 and 600,000 units in 2025, Xu said. Hongqi also plans to develop its own ride-sharing service.

In 2030, FAW, which has partnerships with Volkswagen (DE:) and Toyota (T:), overall aims to sell around 800,000 to a million units, the 55-year-old Xu said.

Hongqi’s ambitious sales targets, however, come as China’s car market is set to fall for a second year in a row. The market is expected to contract by around 8% in 2019 and drop again this year.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.