This post was originally published on this site

https://i-invdn-com.akamaized.net/content/pic8b3ad9069f2a90bee73c995c322b2c88.png

(Bloomberg) — Money managers in India are selling into the recent rally in the nation’s long-tenor bonds.

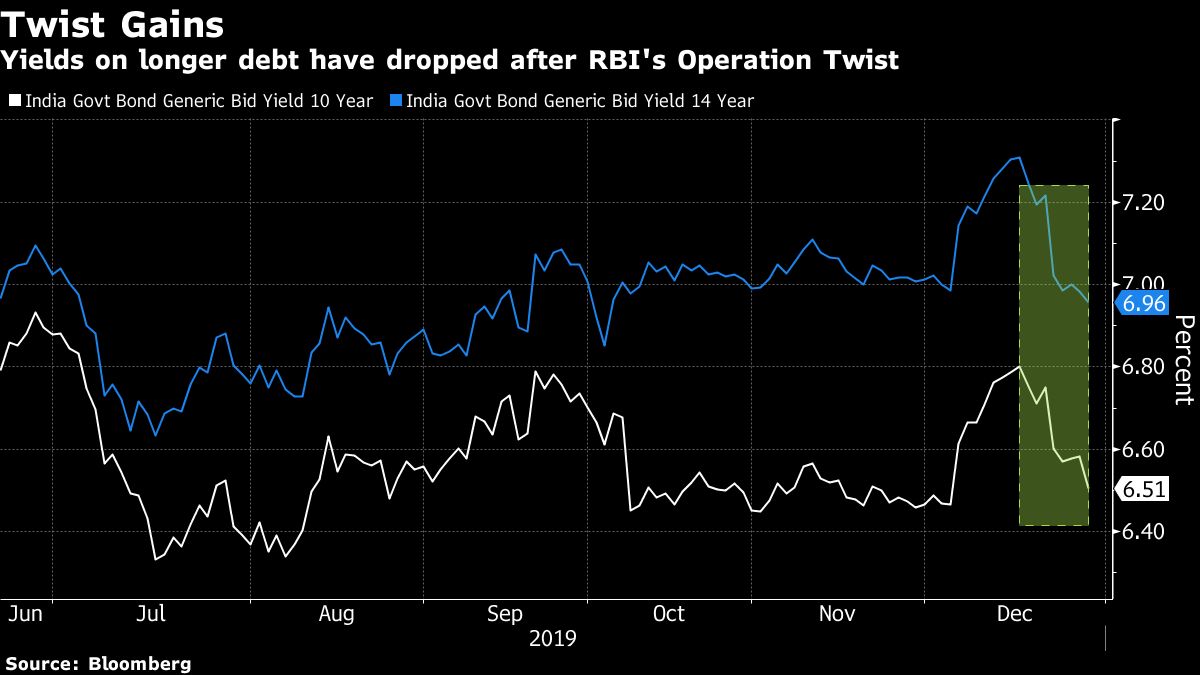

Benchmark yields have slid almost 30 basis points since mid-December, thanks largely to the central bank’s unconventional policy action to buy long-end debt while selling short-end notes. Still, the lingering concern about the government’s fiscal slippage and the risk of a potential rebound in inflation has funds cutting down on duration.

“We have a lot of uncertainty in the bond market in the near term,” said Pankaj Pathak, a fixed-income fund manager at Quantum Asset Management Co. in Mumbai. “Apart from fiscal risks, prices have moved up, vegetable prices have been stubborn at higher levels and the geopolitical scenario has changed for worse.”

The Reserve Bank of India will conduct its third Federal Reserve-style Operation Twist in a month on Monday. The unprecedented moves have come after uncertainty about public finances pushed up the 10-year sovereign yield to near a three-month high of 6.84% last month. It rose four basis points to 6.56% at 10 a.m. in Mumbai on Monday.

“The three consecutive OMOs have actually brought down the valuation premium,” said Pathak. Quantum has lowered its exposure to duration under its dynamic duration fund.

The performance of some long-duration funds since Operation Twist was announced:

Source: Data compiled by Bloomberg

While Finance Minister Nirmala Sitharaman has refused to comment on the deficit goal before the budget presentation on Feb. 1, market watchers widely expect the government to miss the 3.3% target for 2019-20, with some predicting the gap to be closer to 3.8% of GDP.

“We will take this opportunity to reduce exposure by selling bonds at lower yields if possible amid prospects of additional borrowings and hardening of headline inflation,” said Dhawal Dalal, chief investment officer for fixed income at Edelweiss Asset Management Ltd. “We have been maintaining relatively higher duration in most of our duration funds.”

(Adds funds performance table after fifth paragraph)

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.