This post was originally published on this site

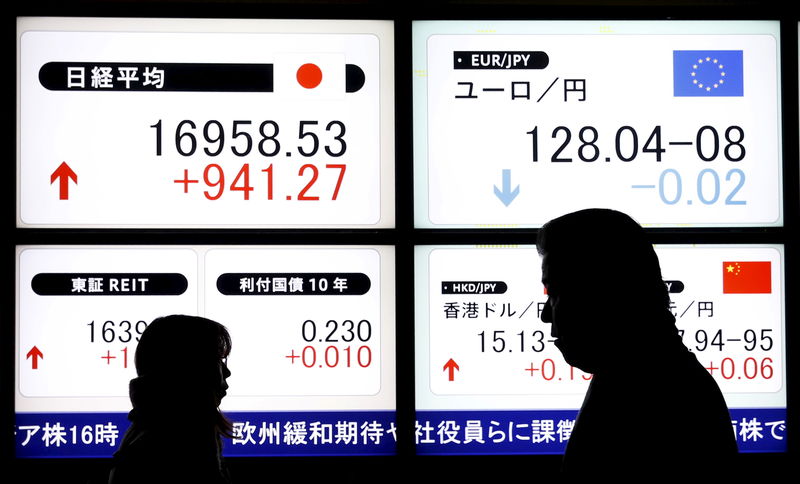

https://i-invdn-com.akamaized.net/news/LYNXNPEC0Q0L5_M.jpg © Reuters. Japan stocks higher at close of trade; Nikkei 225 up 2.55%

© Reuters. Japan stocks higher at close of trade; Nikkei 225 up 2.55%Investing.com – Japan stocks were higher after the close on Friday, as gains in the , and sectors led shares higher.

At the close in Tokyo, the added 2.55% to hit a new 52-week high.

The best performers of the session on the were Tokyo Electron Ltd. (T:), which rose 5.87% or 1380.0 points to trade at 24895.0 at the close. Meanwhile, Yaskawa Electric Corp. (T:) added 5.38% or 220.0 points to end at 4310.0 and Nissan Chemical Industries, Ltd. (T:) was up 5.27% or 240.0 points to 4795.0 in late trade.

The worst performers of the session were Hitachi Zosen Corp. (T:), which fell 1.57% or 7.0 points to trade at 438.0 at the close. Fujitsu Ltd. (T:) declined 0.64% or 65.0 points to end at 10055.0 and NTT Docomo, Inc. (T:) was down 0.49% or 15.0 points to 3025.0.

Rising stocks outnumbered declining ones on the Tokyo Stock Exchange by 2255 to 1320 and 212 ended unchanged.

Shares in Tokyo Electron Ltd. (T:) rose to all time highs; rising 5.87% or 1380.0 to 24895.0.

The , which measures the implied volatility of Nikkei 225 options, was unchanged 0.00% to 15.93.

Crude oil for January delivery was up 0.56% or 0.33 to $59.51 a barrel. Elsewhere in commodities trading, Brent oil for delivery in February rose 0.72% or 0.46 to hit $64.66 a barrel, while the February Gold Futures contract fell 0.09% or 1.35 to trade at $1470.95 a troy ounce.

USD/JPY was up 0.30% to 109.61, while EUR/JPY rose 0.62% to 122.38.

The US Dollar Index Futures was down 0.50% at 96.900.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.