This post was originally published on this site

https://i-invdn-com.akamaized.net/trkd-images/LYNXMPEFAR0OZ_L.jpg

By Sinead Cruise

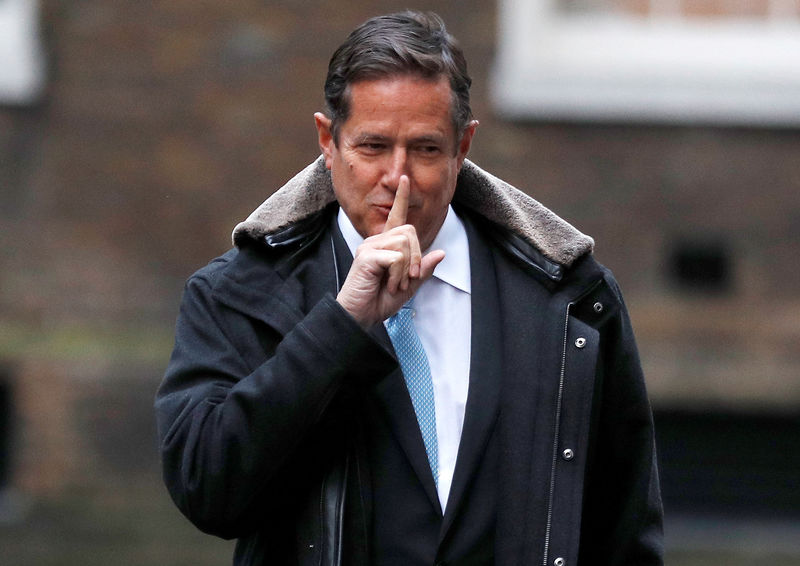

LONDON (Reuters) – Barclays (L:) is planning to cut the 396,000 pounds ($508,068) pension allowance it pays Chief Executive Jes Staley by around half, echoing moves by rivals who have pledged to rein in executive pension perks following a campaign by investors.

The British lender is consulting shareholders on the proposal in a review of its remuneration policy to be voted on at the bank’s annual meeting next year, a source with knowledge of the matter said.

The possible changes follow protests from investors and employee unions over the disparity between pension payouts offered to Britain’s top bank bosses and their staff.

HSBC (L:) and Royal Bank of Scotland (L:) have pledged to set pension contributions paid to their CEOs at 10% of base salary, matching those paid to their wider workforces.

Barclays is looking to boost typical pension contributions paid to employees from 10% to 12.5%, the source added.

But Staley’s new cash payment would equate to around 17% of the 1.18 million pound annual salary he was paid last year, suggesting Barclays is stopping short of full harmonization, risking further investor dissent and scrutiny from policymakers.

“It’s a start but these cuts do not really go far enough. There’s no real reason why CEO pension payments shouldn’t be completely in line with other staff,” Peter Parry, policy director at investor group ShareSoc told Reuters.

“There is always a worry that when companies rein in pay in one area, they compensate for it in another area. The sad thing is that executive pay is now out of control,” he said.

Standard Chartered (L:) still plans to pay its top two executives double the pension benefits it pays to general staff.

Earlier this month it said it would reduce the payouts to CEO Bill Winters and Chief Financial Officer Andy Halford from 20% to 10% of total salary, which includes both base pay and a fixed pay allowance paid in shares.

But as a proportion of base salary alone, the benefit falls from 40% to 20%, compared with 10% for its staff.

The changes mean that Winters’ pension allowance in 2020 will drop to 237,000 pounds and Halford’s to 147,000 pounds.

Lloyds Banking Group (L:) plans to cut the pension allowance paid to its Chief Executive Antonio Horta-Osorio by 228,000 pounds, a source familiar with the situation said.

Horta-Osorio, the longest-serving of Britain’s top banking bosses, pocketed a contribution of around 419,000 pounds this year, equating to 33% of his 1.27 million pounds base salary.

The cut would see his allowance as a percentage of base salary drop to 15%, in line with the maximum contribution the bank plans to offer other staff from 2020.

Horta-Osorio was the sector’s best-paid CEO in 2018, earning a 6.3 million pounds compensation package.

Santander (MC:) UK is now the only major UK lender yet to reform its generous executive pension arrangements.

Its Chief Executive Nathan Bostock takes home a pension allowance equivalent to 35% of his base pay. The arrangements are under review, a source close to the matter said.

At 3.4 million pounds, Staley’s total remuneration package at Barclays for 2018 – which also included a share-based payment of 1.2 million pounds and a 1.1 million pounds bonus – was the lowest among Britain’s bank bosses.

Staley’s proposed pension allowance cut was first reported by the Financial Times.