This post was originally published on this site

https://i-invdn-com.akamaized.net/trkd-images/LYNXMPEFAL00Z_L.jpg

By Andrew Galbraith

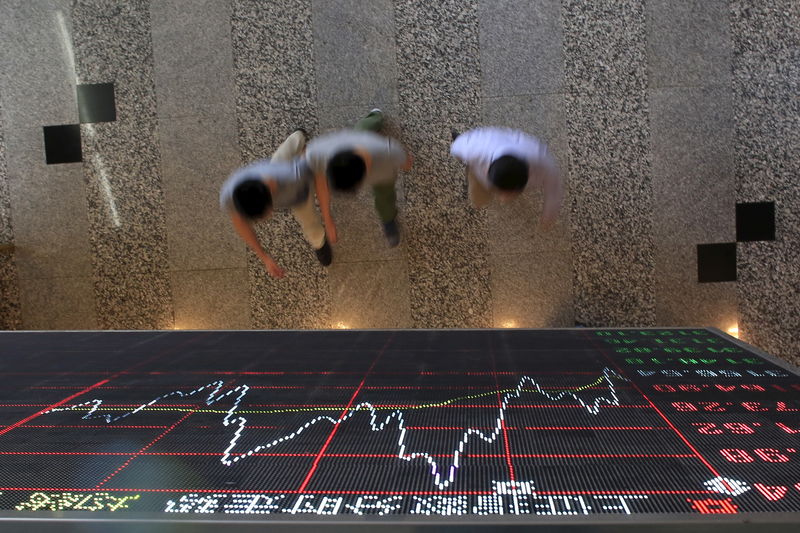

SHANGHAI (Reuters) – Asian equities rose on Friday, bouncing from a three-week low touched a day earlier, but gains were capped by persistent worries over the status of trade negotiations between China and the United States.

Early in the Asian trading day, MSCI’s broadest index of Asia-Pacific shares outside Japan () was up 0.12%. The index had fallen as much as 1.41% on Thursday, hitting its lowest level since October 30, on concerns that U.S. legislation on Hong Kong threatened to undermine trade talks between the world’s two largest economies.

Australian shares () were up 0.52% and Japan’s Nikkei () gained 0.1%.

Worries that a “phase one” trade deal between the United States and China might not occur until next year weighed on investor sentiment on Wall Street overnight, pulling the S&P 500 () down 0.16% to 3,103.54, the Jones down 0.2% to 27,766.29 and the Nasdaq Composite () 0.24% lower to 8,506.21.

Those losses were tempered by China saying it was willing to work with the United States to resolve core trade concerns, and a report in the Wall Street Journal that China has invited top U.S. trade negotiators for a new round of face-to-face talks in Beijing.

“I was ready to give up on a trade deal yesterday. But it seems the Chinese haven’t so I, we, mustn’t,” said Greg McKenna, strategist at McKenna Macro.

But analysts at ANZ said in a morning note that whipsawing hopes over a deal were starting to wear on investors in the 16th month of the U.S.-China trade war.

“It’s fair to say that some signs of trade-headline fatigue are emerging in markets,” analysts at ANZ said in a note.

While Asian stocks ticked higher, U.S. Treasury yields were broadly unchanged after snapping three sessions of declines on Thursday.

The yield on benchmark 10-year Treasury notes () was at 1.7723%, just a hair higher than its U.S. close of 1.772% on Thursday. The policy-sensitive two-year yield (), was at 1.6046% compared with a U.S. close of 1.605%.

In currency markets, the safe-haven yen was a touch stronger, with the dollar dropping 0.05% to 108.58 . The euro was up 0.05% at $1.1063.

The (), which tracks the greenback against a basket of six major rivals, was unchanged at 97.993.

Oil prices retreated after hitting two-month highs on a Reuters report that the Organization of the Petroleum Exporting Countries and its allies are likely to extend existing output cuts until mid-2020.

U.S. crude () dipped 0.41% to $58.34 a barrel.

edged up 0.04% to fetch $1,464.70 per ounce.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.