This post was originally published on this site

https://i-invdn-com.akamaized.net/content/piccb9a6665e2fa27f8f9e36e509375cb67.png

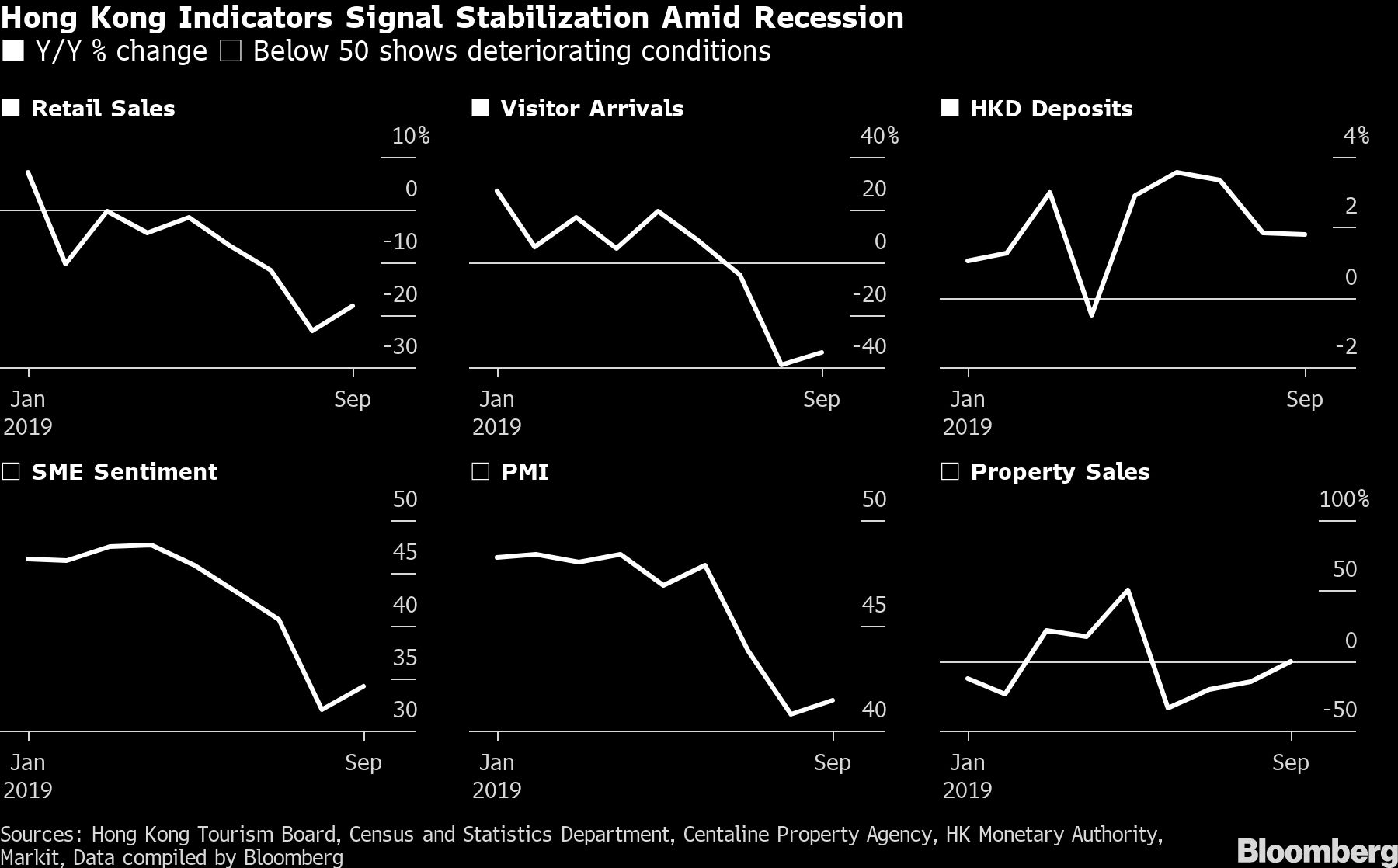

(Bloomberg) — The record weakness facing Hong Kong’s hard-hit retailers continued, albeit at a slower pace, in September as violent protests helped push the city into a recession, data released Friday showed.

Retail sales by value fell 18.3% in the month, compared with a decline of a revised 22.9% in August. Retail sales by volume declined 20.4%.

Hong Kong’s economy contracted sharply in the third quarter, amid months of violent protests in the streets and ongoing trade headwinds from the U.S.-China trade war. Tourism has plummeted across the board, especially arrivals from mainland China, which accounts for almost 80% of all visitors to the city. Financial Secretary Paul Chan has repeatedly called on property owners to cut their retail tenants a break as the slump continues.

Read: Bargain Hunters Revel as Hong Kong Businesses See Life or Death

Police scuffled with protesters and Halloween party-goers in the busy entertainment and shopping area of Lan Kwai Fong Thursday. Riot police closed the holiday hotspot at around 8:30 p.m., leading to tense confrontations with costumed party-goers who were shut out.

As an example of the retail impact of the anti-China and anti-government demonstrations, operating profits among prominent local jewelers including Chow Tai Fook Jewellery Group Ltd. and Luk Fook Holdings International Ltd. may have plunged as much as 45% for the fiscal first half ended September from a year ago, said Catherine Lim, a senior analyst with Bloomberg Intelligence, in an Oct. 16 report. The jewelry chains are set to report earnings at the end of November.

“Gains from mainland Chinese tourism, which drove operating profit at these jewelers’ Hong Kong outlets more than 40% higher in the fiscal year ended March, could diminish into 2020 as a result,” Lim said.

Third-quarter gross domestic product retreated 3.2% from the previous three months, after a 0.4% contraction in the second quarter. That’s the worst slump since 2009, in the aftermath of the global financial crisis. The government said the economy is very likely to contract in 2019 from the previous year.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.